The healthcare sector has many attractive elements, but is also highly complex, which creates numerous issues that investors need to understand. One issue is the presence of large and powerful payors with the ability to dictate reimbursement rates. As a result, the assessment of reimbursement risk is a critical issue in underwriting healthcare deals. While understanding payor dynamics is a recurring healthcare diligence issue, as with all things in healthcare investing, the devil is in the details.

The need for nuanced understanding creates opportunities for informed investors since there are many factors that drive reimbursement risk. Not all healthcare verticals or companies within verticals have equivalent risk. A vertical’s overall size and growth rate, absolute and relative utilization, relative cost of care, and profitability are some of the factors that impact reimbursement risk. Within a given vertical, a provider’s procedure mix, payor concentration, target patient population, commercial insurance terms and local market power are all factors that can reduce or amplify reimbursement risk.

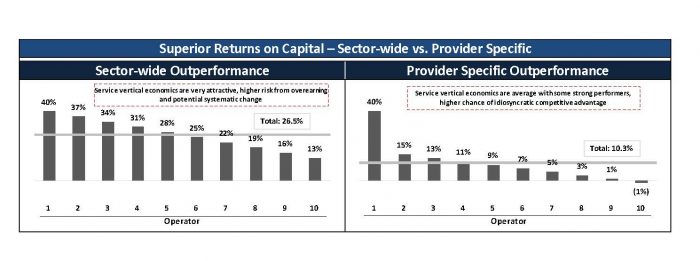

In cases of material payor concentration, assessing industry and company economics is critical to evaluating reimbursement risk, especially when a company is generating attractive returns. While in many industries superior economics is almost always positive, in the healthcare industry lucrative financial characteristics can signal unsustainable overearning. If outperformance is provider-specific, investors must determine whether this is the result of competitive advantage or unsustainable practices. If a sub-sector as a whole is overearning it may be a harbinger of future reimbursement rate cuts, particularly if it seems as if payment rates could be reduced without impacting access to care.

Penfund recently invested in a healthcare service provider that has significant payor concentration and is quite profitable, which made scrutinizing the reimbursement environment a central component of our due diligence. The sector in which the company operates is spread-based – revenue is earned on the basis of hourly payments for services rendered and the company in turn pays providers hourly wages. Since payment and wage rates generally do not vary between providers in the same region, all providers in a region should in theory generate similar levels of profitability. Thus, at first blush it seemed that if this company was highly profitable its competitors were also likely to be highly profitable. This could signal significant reimbursement risk particularly given the concentrated payor base. Thus, a key diligence question was how the company was able to be so profitable. Was it a case of sector-wide outperformance or a case of provider specific outperformance? If the latter, was it due to competitive advantage or potentially unsustainable practices?

Fortunately, the main payors were government entities which both conducted and published significant amounts of research on the sector. There were two important findings from this research. First, overall industry margins were very low and the industry as a whole was only marginally profitable. Thus, this was a case of provider-specific outperformance rather than sector-wide outperformance. Since the services provided were critical and not in excess supply, this indicated that reimbursement risk was likely low. The second finding was that gross margins between providers varied only marginally and the company in question earned gross margins in line with its peers. What distinguished this company was low levels of corporate overhead and other operating costs. Through diligence we learned that this was the result of local market density, scale enabled investments in technology and employee recruiting and retention, as well as tighter and more professional management overall. The result was and is financial performance in what we like to call the Goldilocks zone, the safe space in which a healthcare company earns not too much, not too little, but just the right amount for the right reasons. Thus, by analyzing company and industry economics we were able to get comfortable that margins were sustainable and the level of reimbursement risk acceptable, despite a very high level of payor concentration.

Absent this sort of fundamental underpinning to the company’s high margin profile, we would likely not have pursued this transaction. We often see opportunities in apparently attractive segments of healthcare services that we believe require us to accept greater uncertainty from a reimbursement perspective. In today’s frothy market, we prefer to pick our spots and be aggressive in terms of hold size, terms and pricing in situations like the one described above where we can develop a high degree of conviction.

Back to All NewsAbout Penfund

Penfund is a leading provider of capital to middle market companies throughout North America. The firm is actively investing both senior and junior capital through Penfund Prime and Penfund Capital Fund VII. Penfund manages funds sourced from pension funds, insurance companies, banks, family offices and high-net-worth individuals located in Canada, the United States, the Middle East, and Europe. Penfund has deployed more than C$3.7 billion in 69 investments since 2000. Assets under management are approximately C$3.7 billion.