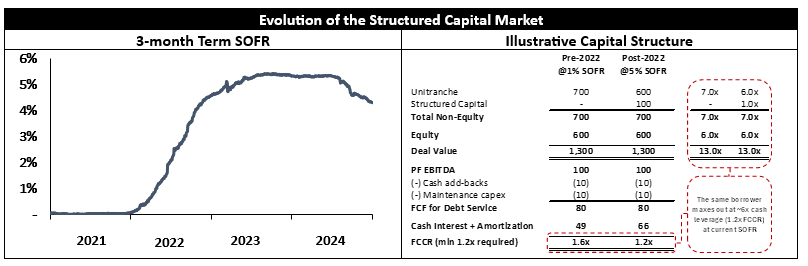

Higher interest rates have forced capital structures in the leveraged finance market to evolve. Borrowers and lenders are adopting capital solutions to manage fixed charge coverage while maintaining the benefits of financial leverage. The growth of structured capital solutions is a direct consequence of this dynamic. Penfund’s targeted approach offers borrowers the benefits of structured capital with highly competitive and more flexible terms than alternatives.

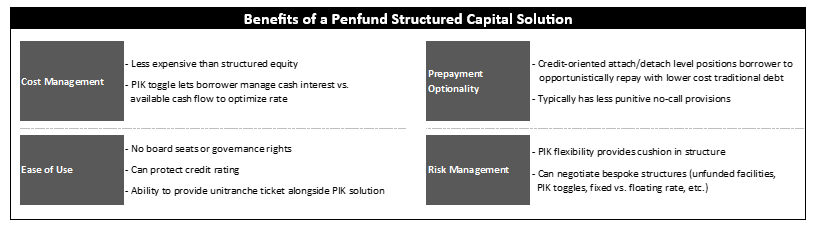

Structured capital is often viewed as an equity substitute. In this context it is expensive, can be dilutive and is deeply subordinated. We consider structured capital a junior debt substitute. Our credit-oriented approach offers our investors and borrowers a risk-return and cost of capital differentiated from equity-like structured solutions. We price and design structured capital to be accretive to sponsors while offering the PIK flexibility, subordination and other attributes borrowers value. The trade-off is that a Penfund solution will attach and detach at similar leverage levels as traditional junior debt. In other words, we may not be the most aggressive option available in the market but offer competitive cost, ease of use and prepayment optionality.

Below are some of the most common scenarios in which Penfund is best positioned to add value to borrowers:

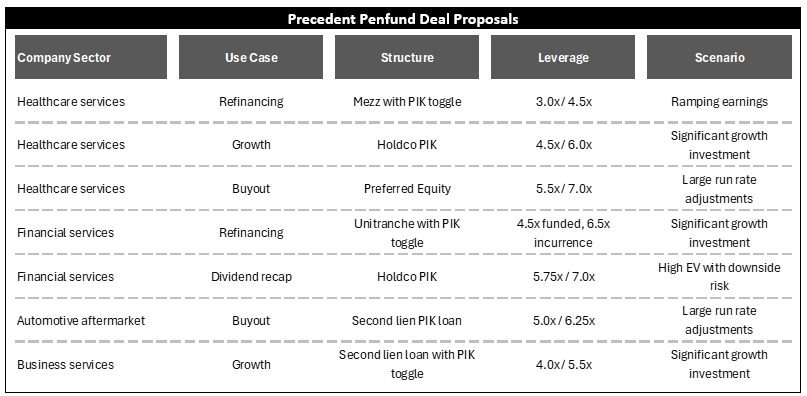

- Businesses with significant and attractive reinvestment opportunities. Growth strategies requiring significant capital investment to scale can create considerable value with well-designed capital structures. In cases where the incremental unit economics of growth investment are both high and consistent across time, markets and/or cohorts, attractively priced structured capital can boost equity returns while managing risk and reducing cash burn. Typical examples include route-based businesses requiring fleet build-out, synergistic acquisition-driven growth strategies and multi-unit businesses with strong de novo economics.

- Inflecting cash earnings profile. Businesses with substantial pro forma adjustments that have not yet converted to cash earnings or with substantial near-term projected earnings growth can often benefit from structured capital solutions. Run rate adjustments for new employees (e.g., insurance brokers, physicians, etc.), acquisition synergies (e.g., cost optimization, supplier consolidation, etc.), ramping de novos, or new customer wins often deserve full earnings credit but may not contribute cash for some time. These businesses can benefit from additional cushion to manage through the period before leverageable earnings contribute to cash flow.

- High enterprise value businesses exposed to transitory volatility. Some sectors have powerful long-term growth potential but can suffer from short-term volatility. Wealth managers with financial market exposure and HVAC service providers with exposure to weather patterns are two examples. In both cases deep equity cushions allow for structured capital solutions to push the leverage envelope while offering downside protection to borrowers.

Penfund has proposed several solutions to sponsors fitting the above criteria:

If you are seeking a partner to provide structured capital in any of the above or similar scenarios, please reach out to any of our partners to learn more about how Penfund can assist.

Back to All NewsAbout Penfund

Penfund is a leading provider of capital to middle market companies throughout North America. The firm is actively investing both senior and junior capital through Penfund Prime and Penfund Capital Fund VII. Penfund manages funds sourced from pension funds, insurance companies, banks, family offices and high-net-worth individuals located in Canada, the United States, the Middle East, and Europe. Penfund has deployed more than C$3.9 billion in 70 investments since 2000. Assets under management are approximately C$3.6 billion.