Like many lenders, Penfund avoids industries experiencing rapid change. It is hard to forecast the future in such industries and unlike equity investors, who can earn a multiple of capital when their forecasts are correct, the prize for being right as a lender in such situations is often early repayment. We seek durable industries that enable borrowers to slowly and steadily deleverage. In recent years, many historically stable industries have been upended by technology and technology-driven companies. COVID-19 has accelerated many of these trends. Here are a few examples:

- E-commerce: The pandemic has increased the challenges faced by bricks and mortar retailers. Overall U.S. retail sales declined significantly through April while e-commerce sales grew rapidly. The result so far has been high-profile bankruptcies and accelerated store closings. Even segments like grocery, that were historically resistant to online competition, have seen rapid growth in online penetration. Online retail market share is unlikely to recede after the pandemic.

- Media & entertainment: As with e-commerce, profound changes in the way consumers spend time have occurred. Live entertainment is on hiatus. Most cinemas are closed. On the other hand, streaming subscriptions, video game sales and social media engagement are setting records. Some of this change will outlast the pandemic, increasing the challenges faced by traditional media and entertainment companies.

- Telehealth: Telehealth, long a service of the future, has become a service of the present. With no alternative, patients are accessing routine healthcare services virtually. Payors are starting to reimburse telehealth at the same rates as in-office visits. Some of our own portfolio companies have quickly ramped virtual care programs. Telehealth seems likely to supplement existing homecare trends, creating both opportunity and challenges for healthcare providers.

In this environment, industries that are not being upended by disruptive change are more scarce and more attractive than ever before. We believe commercial insurance brokerage is such an industry and one example of stability in these uncertain times. This is why we were excited to recently complete a US$100 million investment in a leading U.S.-based mid-market commercial broker.

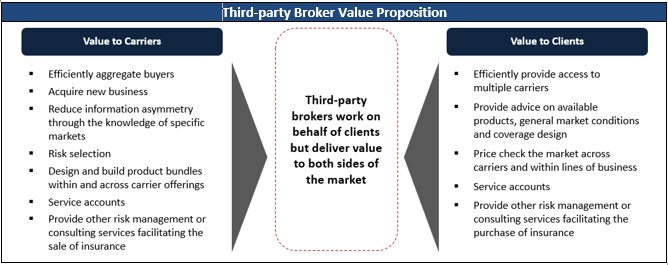

Insurance markets aggregate, select, and allocate risk from businesses and individuals to insurers through a complex network of participants. Brokers fulfill the last mile of the value chain and, as distributors, aggregate supply and demand better than any single insurer or business could on their own. Products, client needs, and carrier capabilities are all highly variable and risks are often large, complex, customized, and difficult to underwrite. While brokers selling certain highly commoditized products have experienced some loss of market share over time, the business model of traditional commercial property and casualty insurance brokers has proven to be stable. The strength of their value proposition to both carriers and clients has enabled them to thrive despite surrounding volatility and tremendous technological change.

As businesses adapt to a post-COVID world, we believe brokers will continue to play a critical role in commercial insurance markets. This does not mean brokers are immune from the external environment. Broker commissions are driven by carrier premiums, so we expect industry revenue to decline in the short and medium-term as premiums adjust to reflect lower levels of economic activity. However, brokers’ exposure to economic conditions is low relative to most other sectors of the economy. Risk is reduced further by backing the right broker, with exposure to the most stable customer and industry segments.

Brokers also benefit from being able to be on both sides of a trend. While some industries will be upended by technology or the pandemic, both winners and losers need to buy insurance and they will generally require a broker to help them do so. This is why broker performance has been so stable over time. We do not see this changing any time soon and expect brokers to continue to deliver value to carriers and clients well into the future regardless of what turmoil and change is wrought by the pandemic.

In fact, if anything, we think COVID-19 may strengthen the best broker platforms. Tail events like the one we are currently living through demonstrate the value of a good insurance policy and a good insurance advisor. In many cases, buyers who thought they had coverage do not and will require broker expertise to navigate the crisis and will come out the other side with a greater appreciation for good advice.

Back to All NewsAbout Penfund

Penfund is a leading provider of capital to middle market companies throughout North America. The firm is actively investing both senior and junior capital through Penfund Prime and Penfund Capital Fund VII. Penfund manages funds sourced from pension funds, insurance companies, banks, family offices and high-net-worth individuals located in Canada, the United States, the Middle East, and Europe. Penfund has invested more than C$3.0 billion in over 225 companies since its establishment. Assets under management are approximately C$3.0 billion.