November 2020

Exploring the Pros & Cons of 1L/2L vs Unitranche Financing Structures

Historically there was relatively little capital devoted to unitranche lending and as a result unitranche facilities larger than a few hundred million dollars in size were not readily available. Unitranche facilities did not generally provide the same leverage as bifurcated structures when they were available. For borrowers with >$75 million in EBITDA unitranches typically weren’t an option and even for smaller borrowers the unitranche cost more than a bifurcated structure. The appeal of the bifurcated structure was obvious – it was the only option for larger borrowers and even for small borrowers the cost was lower. The appeal of the unitranche was simplicity and ease of execution.

As the unitranche grew in popularity with borrowers and lenders, the capital devoted to unitranche lending grew. Unitranches became feasible options for larger borrowers and started to offer leverage comparable to bifurcated structures. As unitranches have become more competitive in more transaction situations, sponsors have come to rely on them more heavily.

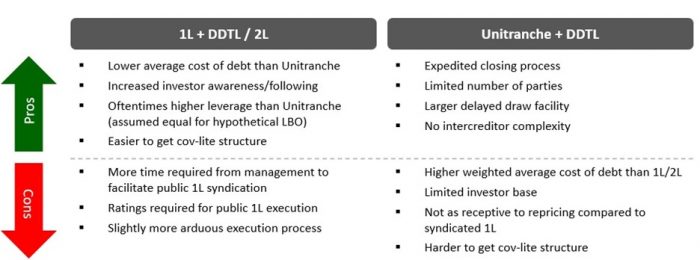

While the unitranche has advantages, bifurcated structures continue to offer compelling benefits to borrowers, principally reduced risk and a lower cost of capital. These advantages are particularly powerful in the current market when companies are able to get large first lien incremental baskets and DDTLs (delayed draw term loans). Whereas a unitranche requires incremental borrowings to be made at the average cost of debt, a bifurcated structure that makes optimal use of incremental baskets can finance incremental borrowings at the cost of first lien debt. By maximizing use of incremental baskets and then periodically refinancing both first and second lien debt and reloading baskets, a bifurcated structure can offer a significantly reduced cost of capital compared to a unitranche.

It is also easier to get cov-lite structures using a bifurcated approach, providing borrowers with additional cushion and flexibility that may not be available with a unitranche. Particularly in the current uncertain economic environment, this flexibility may be important to some borrowers.

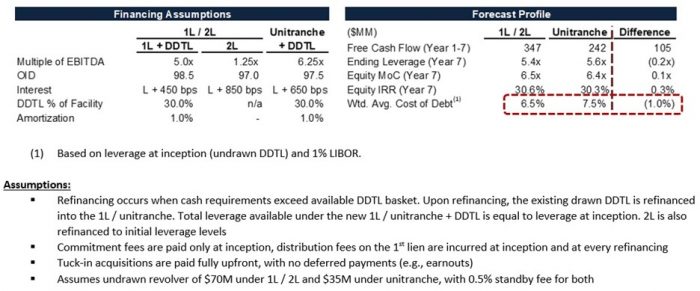

Consider the following example: a $70m EBITDA company that plans to acquire $40m per year of EBITDA at a multiple of 8.0x. If this company starts with opening leverage of 6.25x under either structure and maximizes its use of either 1L or unitranche DDTL facilities, the result is a significantly lower cost of capital, enhanced cash flow and improved equity returns.

In the above example, the bifurcated structure results in a cost of capital that is 1% p.a. less expensive than the unitranche facility. This drives a $105m difference in free cash flow over the investment period. There are, however, other considerations when looking holistically at both alternatives.

Penfund is a relationship lender that remains open for business irrespective of broader market conditions. During the COVID-19 pandemic, we’ve closed two transactions: 1) a US$100m investment in BroadStreet Partners; and 2) an increase in our investment in Caliber Collision to US$160m through a first-lien financing. In our core junior debt fund, we can hold investments of up to US$170m.

Back to All NewsAbout Penfund

Penfund is a leading provider of capital to middle market companies throughout North America. The firm is actively investing both senior and junior capital through Penfund Prime and Penfund Capital Fund VII. Penfund manages funds sourced from pension funds, insurance companies, banks, family offices and high-net-worth individuals located in Canada, the United States, the Middle East, and Europe. Penfund has deployed more than C$3.9 billion in 70 investments since 2000. Assets under management are approximately C$3.6 billion.